- The Workers’ Compensation Act, 2013 (the “Act”) requires the Workers’ Compensation Board (WCB) to maintain a fund (the Injury Fund) sufficient to finance its activities and other obligations under the Act (sections 114, 115, 116). WCB has established this policy to govern and direct the sustainable management of the Injury Fund.

- The Act also authorizes WCB to establish additional reserves to meet losses arising from a disaster or other circumstance which would, in the opinion of the WCB, unfairly burden employers (section 145). These reserves are excluded from the Injury Fund (section 116).

- While the Act clearly states that the WCB is to be fully funded at all times, the level of the Injury Fund and any reserves is left at the discretion of the Board Members.

- The administration and management of WCB investment funds is determined through WCB’s Statement of Investment Policies and Goals (SIP&G).

- Periodically, the WCB undertakes a study of the funding strategy to ensure that the assets of the WCB are sufficient and appropriate to meet its obligations as a going concern. This study may consider scenarios affecting investments, frequency and/or cost of claims, or both.

- The WCB will review the Sufficiency Policy prior to significant changes to accounting standards.

The WCB is experiencing higher than normal call and email volumes. Thank you for your patience. For the quickest support, employers can:

Your Employer’s Payroll Statement (EPS) is due Feb. 28, 2026

Document name

Sufficiency

Document number

POL 16/2023

Effective date: December 31, 2023

Application: Applies to the WCB’s Injury Fund and reserve levels

Policy subject: General

Purpose:

To establish a framework of guidelines, measurements and targets to achieve a fully funded status.

BACKGROUND

POLICY

Principles

- WCB’s approach to maintaining a fully funded status is guided by the following principles:

- Sustainability – WCB strives to balance the need to fund a compensation system for workers and to keep it affordable for the employers that fund the system. To achieve this, WCB will:

- Maintain assets at a level that exceeds benefits liabilities on a funding basis,

- Operate efficiently and within approved administration and capital budgets, and

- Solicit and consider diverse stakeholder perspectives in funding decisions.

- Stability – WCB strives to maintain a reasonable level of stability and predictability in average premium rates over time. To achieve this, WCB will:

- Monitor, assess and analyze historical performance of rate decisions and the impact on funding,

- Develop and maintain a rate setting approach that is consistent year-over-year while maintaining suitable flexibility, and

- Use long-term assumptions and forecasts to smooth out temporary volatility.

- Equity – WCB strives to preserve fairness between groups and generations of employers. To achieve this, WCB will:

- Collect premiums that are expected to fully fund claims incurred in each rate year in accordance with the Rate Setting Model policy, and

- Appropriately measure the financial obligations created by past claims by valuing claims liabilities using accepted actuarial methods and following the Standards of Practice of the Canadian Institute of Actuaries.

- Resilience – WCB strives to maintain a level of financial flexibility to allow for unexpected and/or adverse events. To achieve this, WCB will:

- Prudently invest assets to limit risk and maximize returns as governed by the Statement of Investment Policies and Goals (SIP&G),

- Monitor and evaluate the impact of potential changes to benefit levels through legislation or regulation, and

- Flexibly and proactively manage within the target funding range to limit the need for extraordinary premium levies or surplus distributions.

- Transparency – WCB will strive to provide stakeholders with clear and easy to understand measures of funding adequacy. To achieve this, WCB will:

- Periodically measure and communicate the funding position with stakeholders, and

- Maintain consistency with industry metrics and reporting where possible and explain any differences where they exist.

- Sustainability – WCB strives to balance the need to fund a compensation system for workers and to keep it affordable for the employers that fund the system. To achieve this, WCB will:

Measurement

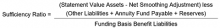

At the end of each fiscal year, WCB’s Sufficiency Ratio will be calculated and reconciled to audited financial statements. The formula for the sufficiency ratio is as follows:

- Statement Value of Assets: This represents the reported value of assets measured consistently with International Financial Reporting Standards (IFRS) presented on the audited financial statements.

- Funding Basis Benefit Liabilities: This represents an actuarially determined required amount for future benefits payments and administration costs arising from both reported and unreported claims resulting from work injuries that occurred during the current and previous fiscal years. This amount is valued using a discount rate that is determined using expected long-term investment returns on the WCB’s portfolio of assets. This differs from the benefits liabilities which are determined under IFRS.

- Annuity Fund Payable: This represents accumulated deferred earnings loss benefits held on behalf of workers.

- Other Liabilities: This represents the balance of non-insurance liabilities including vendor and employee payables, accumulated premium refunds, lease obligations and other liabilities.

- Reserves: These represent amounts set aside to protect against adverse events that could create an unfair burden on employers.

- Net Smoothing Adjustment: To control fluctuations in the market value of investments, a smoothing approach is used to gradually recognize investment gains and losses that differ from the long-term expectation over a five-year period.

- To ensure that the value of assets used in the Sufficiency Ratio does not differ excessively from the market value of assets, the total of the Net Smoothing Adjustment at any calculation point will be capped at a maximum of plus or minus 10 per cent of the market value of assets.

Sufficiency Ratio – Target Range

- WCB’s objective is to maintain the Sufficiency Ratio in a range between 100 per cent and 140 per cent.

- This range ensures sufficient funds are available to meet required benefit levels and protects against unexpected claim activity or potential fluctuating economic conditions.

- The WCB is considered fully funded at a Sufficiency Ratio of 100 per cent.

Surplus Distribution and Deficit Recovery

- If the Sufficiency Ratio shifts out of the targeted range, the WCB will act to replenish or regulate the Injury Fund to return to the targeted range.

- The Board will maintain full discretion over the timing, amount, and methods used to do so, notwithstanding the target time frame described below.

- While exercising this discretion, the Board will balance consideration of both the immediate situation with the long-term stability and sustainability of the Injury Fund.

- When the Sufficiency Ratio is calculated to be outside the defined target range, the WCB will act to restore it to the range over a target time frame of three years.

- If the Board considers it advisable to do so, they may choose to shorten or extend this period at their sole discretion.

- The Board may consider the size of any surplus or deficit, the method intended to be used for any distribution or additional levy, any current or anticipated changes in the operating environment, as well as any other factors specific to the situation that caused the deviation from the range.

- WCB staff will ensure that the WCB website contains up to date information on the Sufficiency Ratio calculation and if any actions to replenish or regulate the fund will be taken. This will also include eligibility rules for any surplus funds distribution.

Reserves

- The WCB may establish additional reserves to meet losses arising from a disaster or other circumstance which would, in the opinion of the WCB, unfairly burden employers. These reserves are maintained in addition to the Injury Fund. In addition to those listed below, special purpose or temporary reserves can be established and included in the Sufficiency Ratio calculation at the direction of the Board through policy or resolution.

- The Disaster Reserve is established to meet the requirements of the Act with respect to disasters (POL 18/2025, Disaster Reserve):

- Disaster – Part 1 covers the potential volatility in less severe disasters. This reserve is set at one per cent of funding basis benefit liabilities.

- Disaster – Part 2 covers rare but severe disasters. This reserve is set at one per cent of funding basis benefit liabilities.

- The Second Injury and Re-employment Reserve provides employers with cost relief on claims that are attributed to an earlier injury, an injury following re-employment and other circumstances established through policy. Based on past utilization of this reserve, the Second Injury and Re-Employment Reserve is set at one per cent of funding basis benefit liabilities as actuarially determined.

- The Strategic Initiative Reserve is established to fund long-term innovation and strategic investments. This reserve will enable WCB to adapt to evolving technologies and capabilities, manage the sufficiency ratio, and maintain low and stable premium rates.

Policy references

Section heading

Legislative Authority

Legislative Authority

The Workers’ Compensation Act, 2013

Sections 2(1)(o), 114, 115, 116, 117, 118, 121, 134, 144, 145, 149, 150, 151

Section heading

Document History

Document History

- December 31, 2025. Housekeeping update to refer to the Strategic Initiative Reserve.

- POL 14/2017 Funding (effective April 19, 2017 to December 30, 2023).

- POL 01/2014 Funding (effective December 31, 2013 to April 18, 2017).

- POL and PRO 02/2013 Funding (effective December 31, 2012 to December 30, 2013).

- POL and PRO 08/2012 Funding (effective September 1, 2012 to December 30, 2012).

- POL and PRO 16/2007 Funding (effective December 31, 2007 to August 31, 2012).

- POL and PRO 01/2005 Funding (effective December 31, 2004 to December 30, 2007).

Section heading

Complements

Complements

POL 18/2021 Governance Policy

POL 01/2024 Annuities

POL 18/2015 Disaster Reserve

POL 17/2023 Occupational Disease - Cost Relief

POL 13/2017 Rate Setting Model

POL 03/2021 Second Injury and Re-Employment Reserve

ADM POL 43/2025 Statement of Investment Policies and Goals (SIP&G)

ADM POL 45/2025 Strategic Initiative Reserve