The WCB is experiencing higher than normal call and email volumes. Thank you for your patience. For the quickest support, employers can:

Your Employer’s Payroll Statement (EPS) is due Feb. 28, 2026

WCB's rate model change in 2018

The WCB adopted changes to its rate model, which impacted the rates employers pay. Learn more about the WCB’s rate model change in 2018.

Changes to the WCB’s rate model will impact the premiums employers pay

The WCB has adopted changes to its rate model, which impacted the rates employers pay. The WCB enhanced its rate model, based on recommendations that came from an external actuary’s (Eckler) review in 2016.

Eckler analyzed the WCB’s model by reviewing detailed information on employers’ payrolls, classification and claim costs, performed various calculations and tests, and reviewed the rate setting models in place at several other Canadian workers’ compensation boards. In formulating a rate model, competing principles must be balanced. The rate model should be robust and sustainable, satisfying the needs, goals and expectations of employers, while being actuarially sound, relatively simple and easy to understand, to communicate and to administer.

The key principles Eckler applied to guide the WCB’s review of the rate model are:

- fairness (accountability, equity and incentives for prevention)

- collective liability (insurance)

- predictability (rate stability)

- transparency (ease of understanding)[1]

Impact to premiums employers pay

Transition to the enhanced model will result in changes to some industries’ rates. Some employers’ rates will not be affected, some will decrease and some rate codes will increase. Understand more about the possible changes to your rate code by viewing the past recorded industry session associated with your rate code.

When will the enhanced model be implemented?

After considering the feedback received from employers following 16 industry information sessions in February and March of 2017, the board approved full transition to the enhanced rate model in 2018.

For 2018 only, to mitigate the impact for industries that are seeing an increase as a result of the transition to the enhanced rate model, the WCB will draw from the injury fund to cover the costs associated with the transition.

The 2019 industry premium rate will be determined under the enhanced model, with no further transition cost drawn from the injury fund.

Board’s decision based on employer feedback

In February 2017, the WCB invited employers’ input on how to transition to the enhanced rate model. The feedback submission closed April 7, 2017. Employers chose from three options for how they’d like the transition to occur:

- transition to the enhanced rate model immediately (2018)

- spread transition over two years (2018-2019)

- other transition option

After selecting an option, each section included a comment section for employers to provide more feedback.

Employer feedback led to the board’s decision to implement the enhanced rate model in 2018. The board also decided to mitigate the impact of the enhanced rate model for the 2018 rate year only by drawing from the injury fund to cover additional costs for employers whose rate codes are increasing due to the changes.

[1] Eckler Ltd., (Sept. 2, 2016), Review of the model to establish the premium rates, from 2016 Eckler Report

Learn how changes to the WCB’s rate model will affect your industry’s premium rate. If you are in one of the following rate codes, your premium rate will be impacted.

View recordings of the sessions on the WCB’s YouTube channel.

Rate model session livestream

2018 Rate Model Education Sessions – Elementary and Secondary Education (G12)

https://app.sli.do/event/a7hbsvbf

Join at Slido.com with #ratemodel2018-1

2018 Rate Model Education Sessions – Health Care (G22)

https://app.sli.do/event/sz9s1gfg

Join at Slido.com with #ratemodel2018-2

2018 Rate Model Education Sessions – Service & Hospitality (S21, S22, S23)

https://app.sli.do/event/iilqughk

Join at Slido.com with #ratemodel2018-3

2018 Rate Model Education Sessions – Offices (S11, S12, S41)

https://app.sli.do/event/3avz4oqk

Join at Slido.com with #ratemodel2018-4

2018 Rate Model Education Sessions – Mining (D73)

https://app.sli.do/event/vu886ak1

Join at Slido.com with #ratemodel2018-5

2018 Rate Model Education Sessions – Food Processing & Manufacturing (M41, M92, M94)

https://app.sli.do/event/ghgvpk0w

Join at Slido.com with #ratemodel2018-6

2018 Rate Model Education Sessions – Service (S32, S33)

https://app.sli.do/event/xqxq81dp

Join at Slido.com with #ratemodel2018-7

The following industry rate codes will be impacted by the changes implemented to the rate model. Find your rate code and view the associated PDF to understand how the changes will impact the premium rates you pay:

- D73 – Underground Hardrock Mining

- G12 – Elementary and Secondary Education

- G22 – Health Authority, Hospitals and Care Homes

- M41 – Dairy Products, Soft Drinks

- M92 – Machine Shops, Manufacturing

- M94 – Iron and Steel Fabrication

- S11 – Legal Offices, Financial, Drafting

- S12 – Offices, Professionals

- S21 – Community and Social Services

- S22 – Restaurants, Catering, Dry Cleaning

- S23 – Hotels, Motels, Taxis

- S32 – Personal, Business and Leisure Services

- S33 – Caretaking, Park Authorities

- S41 – Engineering, Testing and Surveying

View recordings of the sessions on the WCB’s YouTube channel.

The WCB uses its rate model to determine the revenue required in the coming year to cover the expected cost of all injuries occurring in the year as well as its expected administrative costs. The WCB has been using its current rate setting model since 1998.

Following the 2015 Asset Liability Study (conducted by independent actuary, Eckler), a recommendation was made to review the WCB’s rate model.

In 2016, Eckler analyzed the WCB’s Rate Model, in particular the calculations done for the determination of premium rates, obtained detailed information on employers’ payrolls, classification and claim costs, performed various calculations and tests and reviewed the rate setting models in place at several other Canadian workers’ compensation boards.

In September, Eckler released their Rate Model Review report outlining their recommendations for the WCB’s rate model. Their report outlines the 11 recommendations from the rate model review.

Province-wide education sessions

The WCB board and executive conducted a series of province-wide education sessions in the fall of 2016 to share the changes to the rate model. View the recordings of the sessions on the WCB’s YouTube channel.

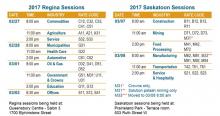

Then in February and March of 2017, they conducted 16 industry-specific sessions outlining what the impact might be in 2018 when the rate model is adopted, based on data available at that time. Recordings are available for all sessions. See links below. The board then asked customers for feedback on how the transition to the revised model should be implemented. This led to the board’s decision to fully implement the new model in 2018 and cover the impact for employers whose rates are going up as a result of the new model implementation in 2018 (for the first year only).

To learn more

Customers can learn the potential impact to industry rate codes. To learn more about how the enhanced rate model impacts on premium rates, view the recorded education and rate model sessions conducted in 2016 and February and March of 2017. These sessions provide information on the impact to 2017 rates had the board implemented the enhancements for the 2017 premium year. These are not 2018 rates but may provide a proxy for actual rates in 2018.

Registration closed

Missed our rate model information sessions? View all recorded sessions below.

Be sure to have your industry’s rate code to help you find the right presentation to view.

Commodities (C12, C32, C33, C41, C51): Monday, February 27 at 8 a.m.

View the recorded session: https://app.sli.do/event/qqa0b3lp

Download Commodities Rate Model Presentation.

Agriculture (A11, A21, A31): Monday, February 27 at 11 a.m.

View the recorded session: https://app.sli.do/event/s89f6lha

Download Agriculture Rate Model Presentation

Service (S32, S33): Monday, February 27 at 2 p.m.

View the recorded session: https://app.sli.do/event/pkbfc4yf

Download Service Rate Model Presentation

Municipalities (G31): Tuesday, February 28 at 8 a.m.

View the recorded session: https://app.sli.do/event/o4hfdbsh

Download Municipalities Rate Model Presentation

Health Care (G22): Tuesday, February 28 at 11 a.m.

View the recorded session: https://app.sli.do/event/cl4unkbw

Download Health Care Rate Model Presentation.

Automotive (C61, C62): Tuesday, February 28 at 2 p.m.

View the recorded session: https://app.sli.do/event/iq3qrruf

Download Automotive Rate Model Presentation.

Oil & Gas (D32, D41, D51, D52): Wednesday, March 1 at 8 a.m.

View the recorded session: https://app.sli.do/event/p9gmbewr

Download Oil & Gas Rate Model Presentation

Government & Crowns (G51, M31, U11, U31): Wednesday, March 1 at 11 a.m.

View the recorded session: https://app.sli.do/event/jb7q1jmb

Download the Government & Crowns Rate Model Presentation

Education (G11, G12): Wednesday, March 1 at 2 p.m.

View the recorded session: https://app.sli.do/event/xfvodheq

Download the Education Rate Model Presentation

Offices (S11, S12, S41): Thursday, March 2 at 8:30 a.m.

View the recorded session: https://app.sli.do/event/oysr2z8z

Download the Offices Rate Model Presentation

Saskatoon sessions

Construction (B11, B12, B13, R11): Tuesday, March 7 at 8 a.m.

View the recorded session: https://app.sli.do/event/rebrqtli

Download the Construction Rate Model Presentation

Mining (D71, D72, D73, M31): Tuesday, March 7 at 11 a.m.

View the recorded session: https://app.sli.do/event/ku7ydc9p

Download the Mining Rate Model Presentation

Food Processing (M41, M42, M72): Tuesday, March 7 at 2 p.m.

View the recorded session: https://app.sli.do/event/eivellof

Download the Food Processing Rate Model Presentation

Manufacturing (M62, M81, M33, M91, M92, M94): Wednesday, March 8 at 8 a.m.

View the recorded session: https://app.sli.do/event/sphwt73w

Download the Manufacturing Rate Model Presentation

Transportation (T42, T51, T61): Wednesday, March 8 at 11 a.m.

View the recorded session: https://app.sli.do/event/hgapznaw

Download the Transportation Rate Model Presentation

Service & Hospitality (S21, S22, S23): Wednesday, March 8 at 2 p.m.

View the recorded session: https://app.sli.do/event/egrrzvec

Download the Service & Hospitality Rate Model Presentation

Download the current rate vs. enhanced rate chart

In 2016, the WCB began public education sessions to educate employers on the rate model review.

The rate model education sessions were held around the province and conducted by WCB executives. Employers and the public had an opportunity to learn about the importance of the rate model review, ask questions and learn about the potential impacts, as well as learn about upcoming industry-specific sessions in February and March of 2017. Employers are urged to attend the upcoming industry-specific sessions in Regina and Saskatoon from Feb. 27 to March 8.

Thank you to all who participated in the rate model review sessions throughout the province. We appreciated your attendance and feedback.

The WCB conducted six education sessions in four locations around the province to educate employers and the public about the recommendations that have come from the rate model review.

|

City |

Date |

|

North Battleford |

Cancelled due to lack of registrations |

|

Saskatoon* |

Wednesday, Nov. 23 |

|

Prince Albert |

Thursday, Nov. 24 |

|

Regina* |

Tuesday, Dec. 6 |

|

Yorkton |

Wednesday, Dec. 7 |

|

Swift Current |

Cancelled due to lack of registrations |

About Eckler:

Eckler is one of Canada’s first actuarial consulting firms dating back to 1927, with offices located in major centres across Canada and the Caribbean. Over the years, the firm has evolved from a strictly actuarial firm to a fully integrated consulting practice spanning the full range of actuarial and related services, including financial services, pensions and benefits, investment, communications, and technology consulting. In addition, Eckler is a recognized expert in workers’ compensation in Canada.

As a Canadian independently owned and operated business, their advice is impartial and clients’ needs always come first. Eckler’s mission is simple: to consistently render informed, expert and timely advice and be recognized as the best in terms of service excellence, value and innovation.

Saskatchewan WCB’s project leader and consulting actuary: Richard Larouche FCIA, FSA EcklerPrincipal

Previous WCB experience:

- Alberta

- Ontario

- PEI

- Quebec

- Manitoba

Richard Larouche is a five-year member of the Workers’ Compensation Committee of the Canadian Institute of Actuaries and acted as chair for three years

Learn how rates are set

Download our 2017 Premium Rate Summary Sheet to find out what your rate code is and the current premiums you pay.

Contact information

Contact a WCB representative to find help.